|

| Fintech services flows away cash from traditional banking channels |

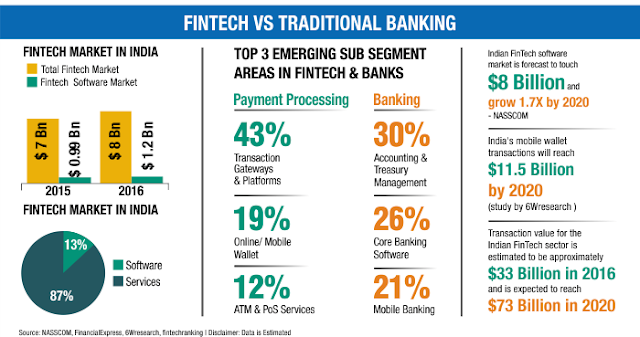

There have been plenty of scandals and controversies in the banking sector and this has been the reason why a large number of people have lost their confidence in the traditional banking system. Just when such problems are arising, Financial Technology (Fintech) is making its way into the market and is rapidly gaining a strong foothold within the industry. As a matter of fact, its widespread adoption has caused people to claim that it is one of the biggest disruptors for the traditional banking systems in recent times. Over the years, traditional banks did try to adopt certain technologies such as e-statements and mobile banking, but customer expectations are also changing.

Fintech seems to have been a boon for everyone, the banked and also the unbanked. Therefore, it is time to look at the way they have changed the entire banking experience. Here are just some of the aspects that have undergone change:

Financial Services for Small Businesses

Banks had gotten apprehensive in lending to small and volatile businesses after the financial crisis that occurred in 2007 and they haven’t changed their stance much since then. Now, Fintech companies have stepped in and succeeded in closing this gap by providing an alternative to small and mid-sized businesses. These Fintech firms are prone to provide more transparency and also lending at a comparatively lesser rate. Traditional banks may have an upper hand in regard to compliance and regulations, but Fintech has taken advantage of their reluctance and built a base of loyal clients in the form of small and medium-sized businesses.

Banking for Non-banking Customers

Even today, there are a number of people out there who don’t have knowledge of and access to banking services. For these people, digital wallets are nothing less than a blessing because most of these people depend on the cash-driven economy. Sure, there is no harm in relying on cash for conducting your transactions, but it is better if you have the means of converting cash into digital currency. Not only does this make financial transactions easy, but also gives your monetary asset an additional level of security.

Increasing Customer Expectations

As customers’ expectations rise, it has become more difficult than ever for banks to manage them. Both private customers as well as businesses now expect convenience, better access and greater flexibility, along with improved transparency. Fintech companies have succeeded in identifying and taking advantage of this gap that exists and have made use of digital channels for providing customers easier access to traditionally closed markets.

Transferring Money with Mobile Devices

Those days are long gone when you had to carry hard cash for making payments. Technologies such as Apple Pay, Samsung Pay and Android Pay amongst others enable the customers to link their bank accounts and credit cards to their mobile phones and other smart devices as well. There has been a significant shift in the way the behavior of customers has changed in regard to banking experience. According to predictions and expectations, the mobile payments market will approximately grow to $3.4 trillion by 2022. If these estimates are taken into account, traditional banks will be left behind if they don’t catch up soon.

Chatbot for Interactive Service

PWC research has revealed that overall higher investments have been attracted by Fintech startups, which are focused on Artificial Intelligence (AI). In the last two years, US $1 billion has been invested in them on average. In the financial sector, the most common use of artificial intelligence has been seen in the form of Chatbot i.e. virtual financial assistance. These have gained a lot of popularity in personal finance apps like Plum , which is a finance chatbot focused on saving or Cleo, which is an AI-enabled application for tracking and managing expenses.

The Introduction of Digital Currency

The rise of digital currency based on blockchain technology has also opened up new doors for Fintech companies because they are ready to use it for driving a cashless economy. A huge number of investors are interested in cryptocurrencies and many of them made investments in Bitcoins, Litecoin and others as blockchain becomes the new big thing.

Advanced encryption is used by cryptocurrencies for regulating the units of transfer funds and value without any central bank or authority having to manage them. While this digital currency is somewhat volatile, there is a good chance that it will eventually become an important part of different industries. When these cryptocurrencies become regulated in the future, they will become even more mainstream amongst banking customers.

Finance Management and Budgeting

In the traditional system, when people wanted to take investment decisions and were looking for advice or wished to manage their finances, they sought out the expertise of wealth managers. However, this is no longer the same because we are now living in a technologically advanced world.

For instance, Mint.com is a personal finance management service based on the web and it aids customers in keeping track of their savings and expenses accordingly. These days, we have a wide array of financial services and tools at our disposal, but managing all of them simultaneously can also be difficult. Therefore, Fintech companies have decided to step in because this can help in making things easier for their clients.

Suffice it to say, these Fintech companies have been very effective in disrupting the retail banking industry, but it is also a fact that there is a lot of ground they have yet to cover. One of the biggest obstacles standing in their way is the presence that traditional banks have held and are still holding in the global financial markets. Furthermore, these banks also hold the favor of the rules and regulations implemented by the banks.

Nonetheless, this doesn’t mean that the situation is bleak for Fintech companies because they understand their weaknesses. They are making an effort to make their presence felt and are educating businesses about the potential they hold. The entire financial services ecosystem can benefit if these Fintech companies and banks collaborate with each other.